If you’ve looked at the ads in your Sunday paper lately, you know what time of the year it is . . . Back to School season! With most students starting classes later this month, retailers across the country are planning for the influx of shoppers looking for the best deals on back to school clothes and supplies. Hopefully, students are taking advantage of their last few weeks of summer vacation. If they planned ahead, they are well on their way to finishing their summer reading and won’t have to cram an entire summer’s worth into these last few weeks. Parents are starting to think about getting back into their school-year routine with non-stop practices and activities. Needless to say, back to school planning has begun!

But when it comes to planning for paying for college, Americans haven’t been relatively successful. According to a recent study on how Americans pay for college, close to 9 in 10 families said they knew their child would attend college as early as his or her enrollment in preschool. Despite that knowledge, only 4 in 10 families had created a plan to pay for all years of college before their child enrolled. That means roughly 60% of families “plan” to address paying for college when the student actually goes to college.

In a recent survey on college pricing, the average cost of tuition and fees for the 2016-2017 school year was $33,480 at private colleges, $9,650 for in-state residents at public colleges, and $24,930 for out-of-state residents attending public universities. While those costs grew at a slower rate in 2017, from 1990 through 2016, the average annual increase in tuition was 6% per year – more than double the rate of inflation. Not surprisingly, student loan debt is at an all-time high. In recent years, studies have shown that 70% of students graduate with student loans, with the average 2016 graduate holding $37,172 in student debt.

As education costs continue to increase and more and more students are saddled with debt to fund their education to achieve their goals, back to school season is the perfect time to start thinking about your family’s plan for education expenses.

Saving for College with 529 Plans

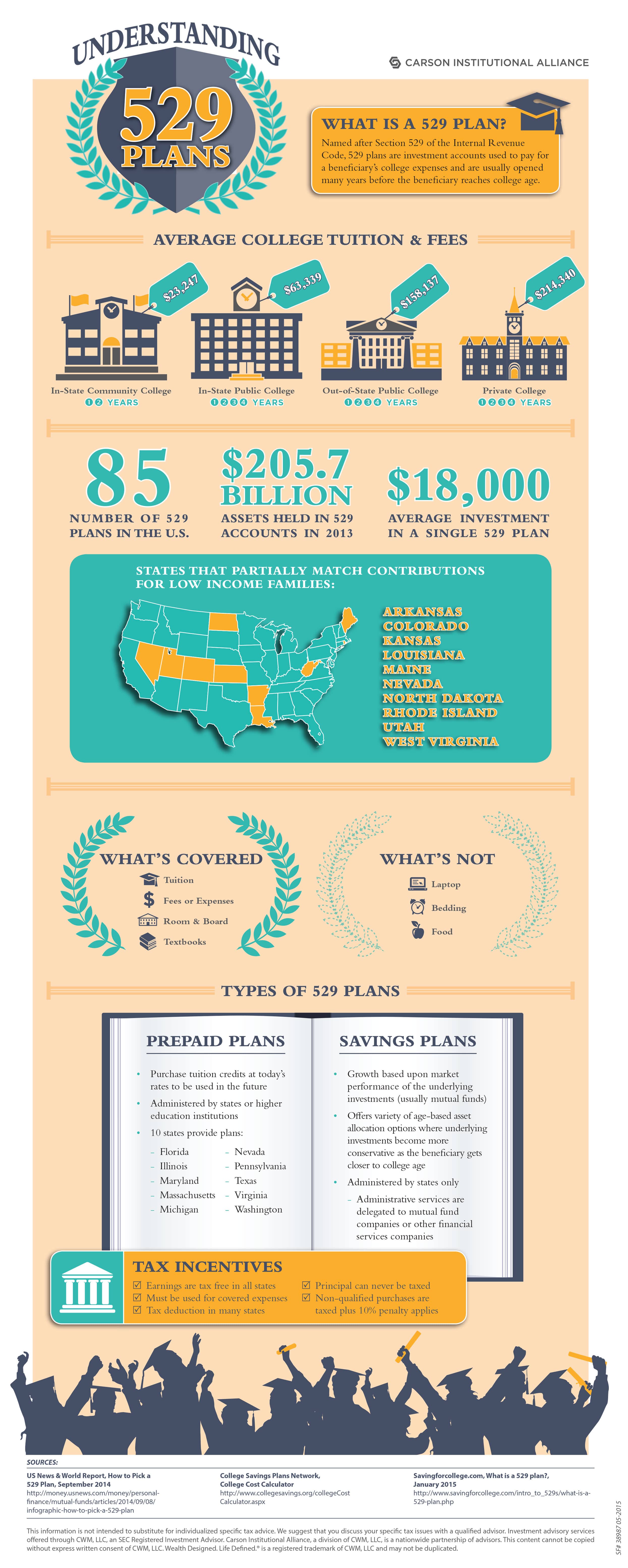

529 plans are one of the best ways to save for your child’s college education. Named after Section 529 of the Internal Revenue Code, a 529 plan is an investment account used to pay for a beneficiary’s college expenses. 529 Plans have been available since 1996, but only a 13% of families used them to pay for college in 2016-17, down from 16% the prior year. A family can invest in a 529 plan account without the earnings being taxed as long as the funds are used to pay for qualified expenses. Other benefits include :

• Some states allow tax deductions or credits for 529 plan contributions

• Funds can be used for undergraduate, graduate, technical or trade schools

• You can choose any state’s 529 plan and there is no limit on the number of 529 plan accounts you can hold at one time

• Wide variety of investment choices

• Family members and others can make contributions to the account

• Accounts won’t expire and you have the ability to change beneficiaries

• Ability to front-load five years’ worth of gifting – up to $70,000 for an individual or $140,000 per couple – into a 529 plan

• If you don’t have children yet, you can still open an account and name yourself as the beneficiary and then transfer the assets to the child later

Withdrawing Funds from 529 Plans

If you’ve set up a 529 plan or are thinking about setting one up, you’ll eventually need to withdraw the funds to pay for education expenses. If funds are withdrawn for non-qualified expenses, the earnings will be subject to a 10% withdrawal penalty and will be taxed as ordinary income. You’ve worked hard to set up and fund the account, so it’s important to know what expenses are covered and how you can avoid paying penalties.

Qualified expenses include amounts paid for:

• Tuition & Fees

• Books & Supplies

• Computers and related equipment

• Some room and board expenses

Qualified expenses do not include:

• Transportation

• Student loan payments

• General electronics and cell phone plans

• Sport and fitness club memberships

• Health insurance premiums

Also, keep this in mind – withdrawals must match the tax year of the qualified expense payments to the school. Don’t withdraw funds from the 529 plan this year and wait until the following year to pay the school. By spanning two tax years, you risk paying taxes and penalties on a portion of the distribution.

What to do with Excess Funds

Perhaps your child received a scholarship and doesn’t a portion of the 529 plan account. No problem – just change the beneficiary to another family member who is planning to go to college. You can also change the beneficiary to yourself and further your own education. If you’re not quite a grandparent but may be in the future, wait until your grandchild is born, make them the beneficiary and give them a head start on their college planning. If none of these are options, you can distribute the funds to the beneficiary or to you as the owner. Keep in mind – earnings will be subject to a 10% penalty and will be included in the distributee’s taxable income.

Are you ready to plan your child’s educational future and want to take advantage of tax-free growth?

Check out our 529 Plan infographic and Contact your Advisor today!

Before investing, the investor should consider whether the investor’s or beneficiary’s home state offers any state tax or other benefits available only from that state’s 529 Plan.

https://www.salliemae.com/assets/Research/HAP/HowAmericaPaysforCollege2017.pdf

https://www.collegedata.com/cs/content/content_payarticle_tmpl.jhtml?articleId=10064

https://www.businessinsider.com/college-tuition-growth-slows-2017-7

https://www.usnews.com/education/best-colleges/paying-for-college/slideshows/10-student-loan-facts-college-grads-need-to-know

https://www.salliemae.com/assets/Research/HAP/HowAmericaPaysforCollege2017.pdf

https://www.cnbc.com/2017/05/04/10-hidden-benefits-of-529-plans.html