Tax planning takes into account the larger picture of your investments, assets, estate strategy and other parts of life to protect your finances over decades – not just hope to do better than last year’s income tax return. From your personal healthcare and retirement plans to working within …

Continue Reading!

After multiple attempts at retirement legislation in 2022, the SECURE 2.0 Act has passed, with arguably more impactful reform than its predecessor, the SECURE Act of 2019. Download the checklist today to get started.

Continue Reading!

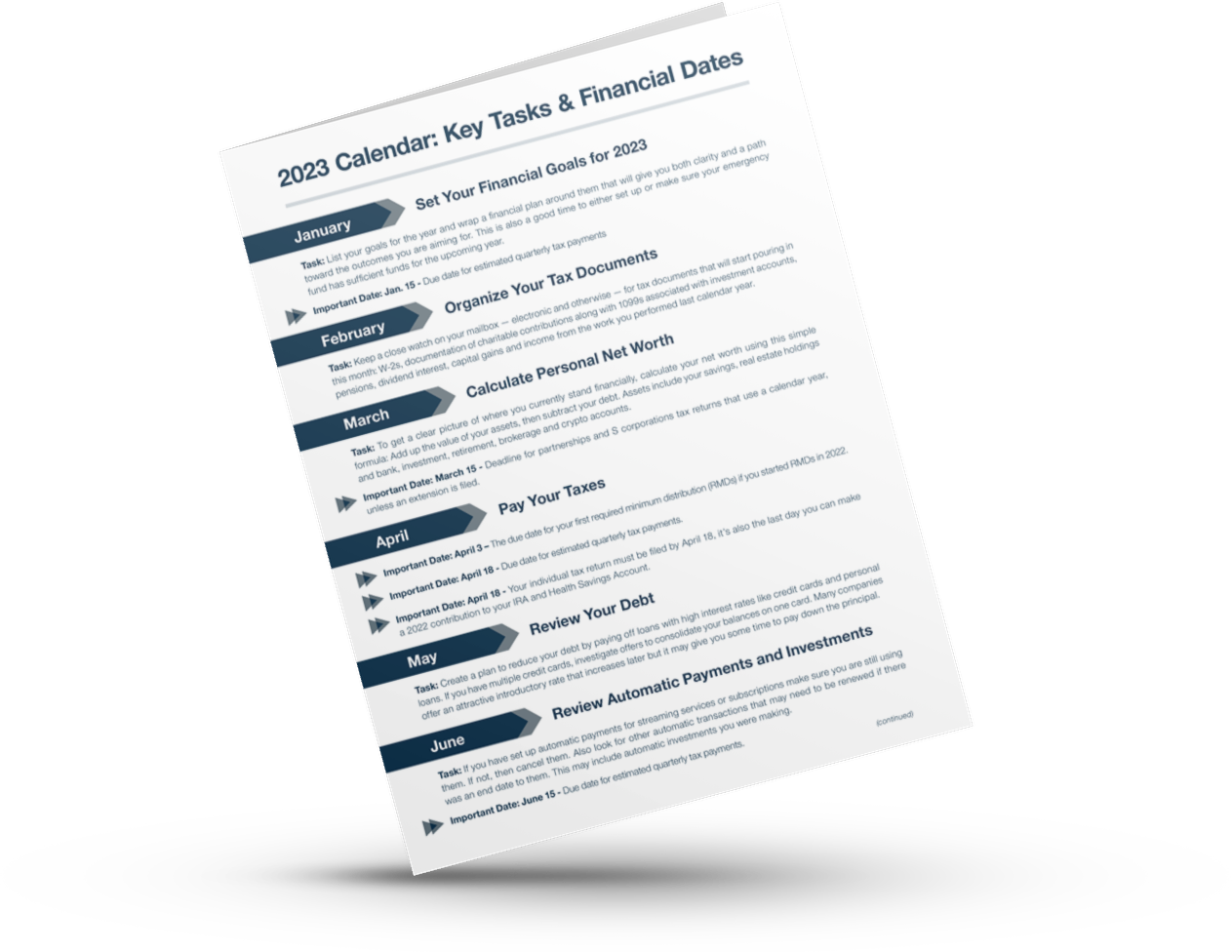

Get ready to tackle 2023 with this month-by-month financial task list. We’ve also included important dates so you won’t miss key deadlines. Download the checklist today to get started.

Continue Reading!

Change happens. And whether we carefully plan for these changes, or we are taken by surprise by change, it’s how we react to those changes that help dictate if they will ultimately be to our advantage. Whether it’s a sudden inheritance, or a divorce settlement that is higher tha …

Continue Reading!

Have questions about how to incorporate your employee benefits into your financial plan? Talk to your financial advisor today or request an initial meeting with one of our highly qualified fiduciary advisors. Download the checklist today to get started.

Continue Reading!

Determining what age to begin claiming your Social Security benefit can be a big decision. Do you claim early at age 62? Take it at your full retirement age? Or delay until age 70? There are a wide variety of factors that can go into your final decision, and you should always consult with a …

Continue Reading!