Published by Scott Kubie, Senior Investment Strategist

The French elections starting on April 23 are the biggest market moving political event until the recently called British elections. Below are five things to keep in mind that may prevent you from overreacting to a negative outcome in round one:

- LePen is generally thought of as the furthest right and Melenchon as the furthest left candidate. Fillon, Macron and Hamon fit in between them. A better analysis would put LePen as the most culturally conservative candidate and Fillon as the most economically conservative. LePen and Melenchon, while far apart ideologically, both oppose the European Union while the other three support ongoing French membership. LePen’s populist conservatism invites comparisons between her approach and President Trump. I would place Trump somewhere between LePen and Fillon.[ii]

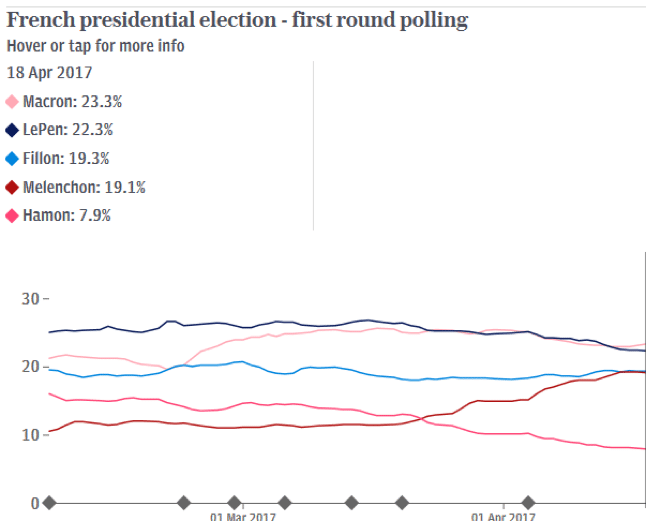

- Don’t panic if LePen wins the first round. The French elections are conducted in two stages. The first round takes place April 23. The top two vote getters from the first round advance to the second round. Turnout for mainstream candidates (Macron, Fillion and Hamon) may be less enthusiastic in the first round. On the other hand, LePen and Melenchon will likely have very strong turnouts.

In the 2015 regional elections LePen’s party, the National Front, was the top vote getter in the first round in six of the thirteen regions. Those that oppose her are less likely to vote in the early round or spread their votes across a wide range of candidates. LePen’s party was shutout in the second round of voting. In all six regions higher turnout and only one other choice left National Front on the outside again.[iii]

- If both of the anti-European Union candidates win, markets will likely drop and may drop sharply. France is crucial to the European Union and the Euro currency. It is the second largest economy in the Eurozone and geographically connects the less competitive southern European countries to the more industrious north. The prospects of a Macron-Melenchon second round should motivate turnout for the other three candidates. If it doesn’t, then look out.

- Fillon and Macron are the two most attractive candidates for investors. Fillon was the Prime Minister during the Sarkozy administration. He is viewed as pro-business and favors abolishing the 35 hour work week. Fillon led in the early polls, but a scandal regarding family members earning a government salary while doing little work created the space for Macron to rise.[iv]

- François Hollande, France’s current center-left president, is wildly unpopular. Hamon, who is from the same political party, has steadily lost share to Melenchon in recent months. This trend reflects a move leftward by progressive voters across the globe. The strong primary challenged offered by Bernie Sanders is another example of this trend.[v]

If you have any questions about this election or the markets, contact your trusted advisor.

[i] https://www.telegraph.co.uk/news/0/french-presidential-election-poll-tracker-odds/

[ii] https://www.cnsnews.com/news/article/fay-al-benhassain/

[iii] https://www.theguardian.com/world/live/2015/dec/13/french-regional-elections-2015-live

[iv] https://www.france24.com/en/20170413-french-presidential-candidates-divided-35-hour-week-economy-employment

[v] https://www.france24.com/en/20170405-france-president-francois-hollande-five-years-not-normal-look-back