During the past decade, ending December 2019, low volatility investing has been embraced by many investors due to above average adjusted performance. With the turn of events, the year 2020 witnessed a negative surprise for low volatility stocks. This surprise further intensified when value investing seemed to make a comeback as COVID-19 vaccines arrived. In 2020, low volatility stocks did not profit during the cyclical growth rally seen between April and September, nor the cyclical value rally witnessed from October to December — low volatility strategies like QBI got “stuck in the middle.” We remain confident and continue to believe QBI strategies are a great alternative for investors who want exposure to stocks but with less risk. However, we recommend the QBI strategies should not be used as a substitute for dedicated value strategies.

Value and Low Volatility

Investors often confuse “low volatility” for “value” as paying a relatively low price for an asset tends to be a good starting point for investing to generate outperformance in the future. In broad terms, “value” is determined by the cheapness of stocks relative to peers. Although “low-volatility” strategies may have exposure to value, they have different intended outcomes compared to value. A low volatility strategy like QBI seeks to reallocate risks from the market factors to other sources of equity returns to form a risk-balanced portfolio. A low volatility strategy sometimes gets benefitted from market mispricing connected with volatility due to investors’ risk aversion. On the other hand, investors believe low-risk stocks tend to trade at lower valuations and can be more profitable than the broader market. Hence, a low volatility strategy may carry some value premium. It is important to remember, though, that a low-variance or a multifactor strategy may carry exposure to value, but they don’t explicitly target stocks trading at a lower valuation relative to the broader market.

Let’s discuss why investors should consider a low volatility strategy in a portfolio, which refers to a conundrum, known as the Low-Volatility Anomaly. The economic theory suggests higher expected returns correspond to higher expected risk. In other words, it is generally considered that more risk equals more return, and low volatility is low risk, thus equating to lower return. This widely held belief may not always hold. Academic research over the years has found that a portfolio of low volatility stocks can produce higher risk-adjusted returns than a portfolio of high volatility stocks.[1]

Why may this be the case? One explanation is rooted in behavioral finance theories such as the “lottery effect.” The “lottery effect” states that, at times, investors are more willing to chase high-beta names (stocks with higher market risks) after they have spiked in price to achieve lottery like returns. Put simply, even if the probability of winning is low, the chance at a large payout is too enticing to ignore. The increase in demand on these high-beta names pushes prices up artificially, potentially decreasing future returns.

Is this time different?

In 2020, COVID-19 brought an unprecedented impact on markets, and on typical low volatility names, as it has hastened the trend towards an online economy associated with investors’ ambitious expectations for growth stocks. Markets have been driven by return seekers and risk seems to be less of an issue, given the deployment of massive fiscal and monetary stimulus.

Underperformance can be a painful experience even when your clients are not losing money but are comparing portfolio performance to the ‘exciting’ Nasdaq returns. Low volatility stocks are less ‘exciting’, and this always been the case. It’s important to understand the role of ‘boring’ low volatility strategy. As implied, it helps build portfolios that are less risky than the market, and not one that is expected to deliver market-beating total returns.

While it is always possible that “this time is different,” our review of low-volatility factor underperformance has not cracked our confidence in the factor. We believe defensive low-vol strategies should not be written off.

Not Only Low-Volatility But Multi-Factor

QBI’s systematic, factor model-based strategy was created to exploit the low volatility anomaly by providing a portfolio designed to lessen downside exposure while still offering participation in up markets. The defensive nature of the strategy means the portfolio will tend to lag during rising equity markets but will tend to outperform during declining equity markets.

To accomplish this, the QBI model uses not only a low volatility factor to identify stocks, but also three additional factors. Why other factors? Factors can go in and out of favor with market cycles and diversification benefits can be had by adding additional factors. To enhance returns, while still maintaining a core low volatility profile, QBI’s diversified multi-factor model uses the following four factors: low volatility (40%), value (25%), quality (25%), and momentum (10%).

Over A Full Market Cycle

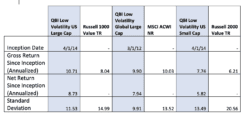

Over a full market cycle, the goal of the QBI strategies is to produce market-like returns with less volatility. Table 1 below shows that since inception, the portfolios have all experienced lower volatility than their respective benchmarks while producing either better, or similar returns, than their corresponding benchmarks before fees.

Table 1. Gross return and standard deviations as of 12/31/20. Past performance is not indicative of future results. TR indicates total return. NR indicates net return. Net Return indicates that this series approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction of withholding tax. Standard Deviation is a statistical measure that depicts how widely the returns of an investment varied over a certain period of time.

There are many reasons why investors should make a strategic investment in low volatility stocks. We have seen that this defensive style gives investors access to the long-term equity premium, but at lower risk. We believe the long-term evidence of Low Volatility Anomaly is very strong, which is probably one of the largest and most significant anomalies in finance.

We advocate investor patience and continue to emphasize the need for building all-weather portfolios especially in volatile market environments. We also believe the market cycle will eventually return to its normalized long-term nature. Indeed, a full market cycle is the ideal investment horizon for low volatility strategies to stand out.

[1] Example includes: Blitz, David and van Vliet, Pim, The Volatility Effect: Lower Risk Without Lower Return (July 4, 2007). Journal of Portfolio Management, pp. 102-113, Fall 2007, ERIM Report Series Reference No. ERS-2007-044-F&A, Available at SSRN: https://ssrn.com/abstract=980865