Published by Mark Petersen

Many people struggle with determining how much inheritance to leave their children and future generations. As Wealth Planners, we often here the goal, “I want to leave enough wealth to my children to provide them with opportunity. However, I do not want to leave them so much they do not have to work.”

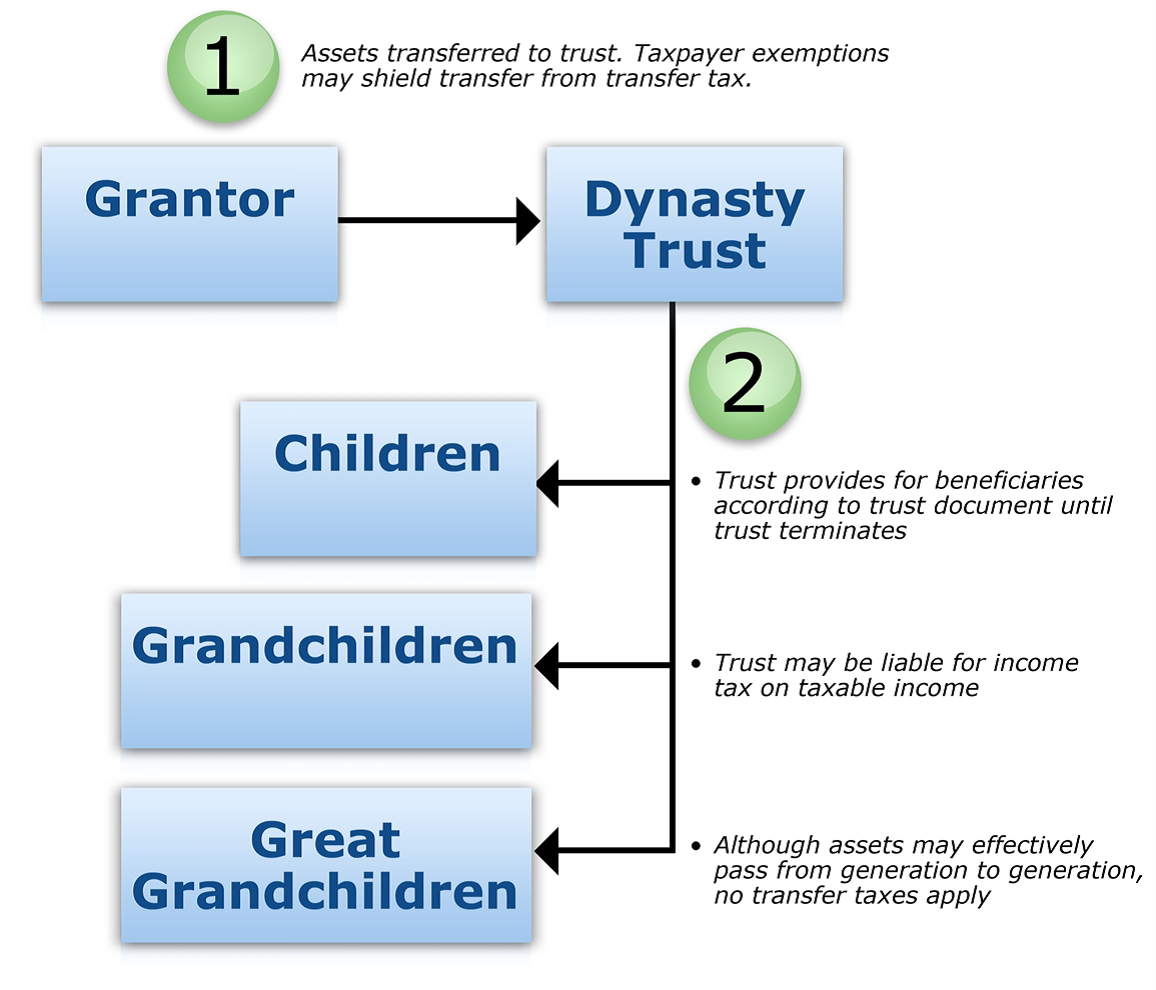

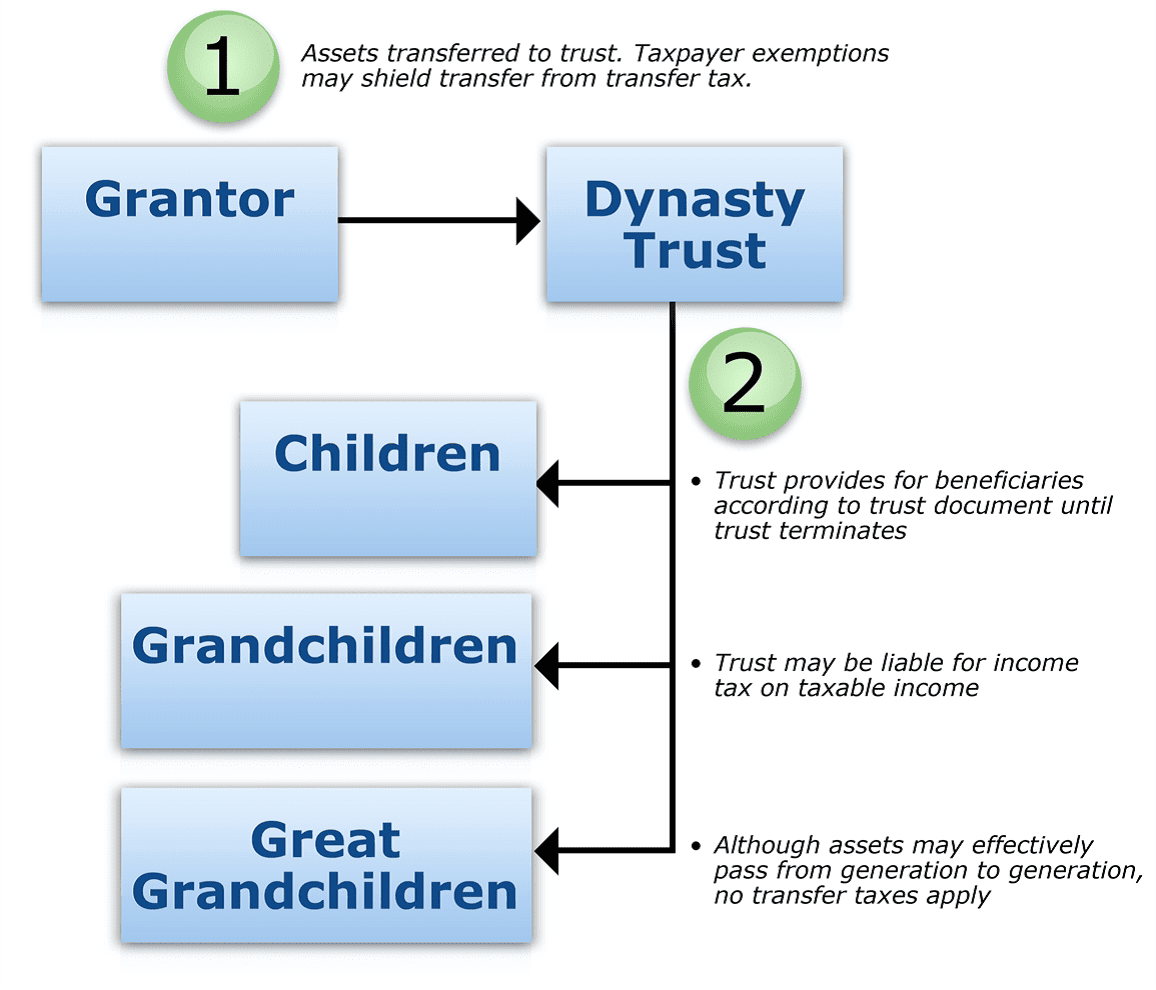

One planning tool we have available to address the inheritance goal while providing flexibility for changing circumstances is a DYNASTY TRUST. A dynasty trust is a long-term trust created to pass wealth from generation to generation without incurring transfer taxes such as estate and gift tax. A dynasty trust’s defining characteristic is its term.

- The trust may survive for 21 years after the death of the last beneficiary who was alive when the trust was created, and it can theoretically last for more than 100 years. Some states now allow trusts to exist in perpetuity or never expire.

- The beneficiaries of a dynasty trust are usually the grantor’s children, and after the death of the last child, the grantor’s grandchildren or great-grandchildren generally become the beneficiaries.

- The trust’s operation is controlled by the Trustee who is appointed by the grantor.

- The dynasty trust is irrevocable, which means that once it is funded, the grantor will not have any control over the assets or be permitted to amend the trust terms.

In order to reduce the loss of billions of dollars in estate taxes, Congress enacted the generation-skipping transfer tax (GSTT) in the Tax Reform Act of 1986. While the GSTT is applicable to dynasty trusts, every individual (as of 2014) has a GSTT exemption of $5.34 million, or $10.68 million in case of a married couple.

At a 7% projected net annual return with an assumed combined federal and state tax rate of 45.6 percent and a 2 percent annual distribution rate payable to beneficiaries, a dynasty trust funded with $10.68 million will distribute approximately $61 million and retain a value of about $66 million over a 100 year time period without incurring transfer taxes.

This example shows the power of compounding and how it is amplified over time. The ability to combine compounding with the elimination of transfer taxes by utilizing a dynasty trust is very powerful tool in the right circumstances. As with all planning tools, there advantages and disadvantages:

Advantages:

- May be structured to preserve family wealth for generations

- Minimize transfer taxes

- May be structured to protect assets from spendthrift beneficiaries, spousal divorce claims and unforeseen creditors

Disadvantages:

- The trust is irrevocable

- Leaves future generations with limited flexibility to manage changes in circumstances

A dynasty trust may help answer the question of how much is enough but not too much when considering inheritance, not only for children, but for grandchildren and great-grandchildren. If your goal is to leave a legacy which will last for generations, the answer may just lie in creating a dynasty…trust.