Published by Scott Kubie

Recently, a fee-only financial advisor mentioned to me that more clients are proposing to manage more of their own assets and invest in the “S&P 500.” For most who go down this path, this move will likely end badly. These investors, while seeking to avoid wealth management fees, are ignoring the value their advisor brings to them as well as the current market environment.

One major way advisors help clients is making sure their investments align with their risk tolerance. The move to investing in the S&P 500, outside of the managed portfolio, often increases the risk of the client’s portfolio above what they are willing to tolerate over the long-term. Any downturn will likely result in larger losses than the client is willing to tolerate.

Adding the S&P 500 to portfolios will likely make many portfolios less diversified. When analyzing portfolios from the standpoint of risk, rather than asset class, it is common for 90% or more of the risk to come from allocations that move similarly to the S&P 500. Through innovations in risk measurement and portfolio management, some fee-only financial planners have structured portfolios that offer enhanced diversification while avoiding much of the interest rate risk in the bond market. By jumping outside of the plan, investors are also stepping away from these innovations in favor of a blunt tool.

The move also throws off the financial plan. For some investors, there is no need to push the risk of the portfolio higher. The allocation they have is already designed to help them reach their goals and then some. In pursuit of returns, they are putting at risk the ability to meet goals that were well within reach.

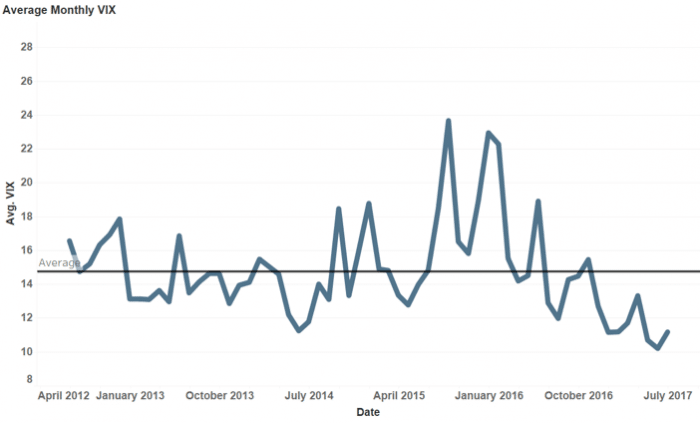

Many of these moves are occurring when the volatility of the U.S. stock market is extremely low and returns have been very strong. The chart below shows the VIX, a measure of estimated volatility, in recent years. You can see that risk expectations are at a multi-year low. The U.S. stock market has also posted extremely attractive returns that have been above other alternatives.

Source: Morningstar Direct

When the markets goes through a rough patch or other segments outperform, many of the investors who are chasing returns with the S&P 500 will be chased right out of the market. Fee-only financial planners steer clients to help reach their goals and stop clients from chasing asset classes that have done too well for too long.

Investors cannot invest directly in indexes. The performance of any index is not indicative of the performance of any investment and does not take into account the effects of inflation and the fees and expenses associated with investing.